Are you imagining of owning your perfect home but encountering obstacles in the traditional financing route? A low doc loan could be your solution to making that dream a reality.

These loans are tailored for individuals who may have the standard documentation required by traditional lenders. Whether you're self-employed, have a unique income source, Low Doc Home Loan or simply prefer a simpler application procedure, low doc loans can offer adaptability.

With a low doc loan, you can often secure funding faster and with less paperwork, allowing you to settle into your dream home sooner.

Don't let the typical financing system hold you back any longer. Explore the advantages of a low doc loan and uncover how it can unlock the door to your dream home.

Get Approved Faster : The Power of Low Doc Mortgages

Securing a mortgage can often be a time-consuming process. But what if there was a way to rapidly streamline that journey? Enter low doc mortgages, a convenient financing option designed to make the acceptance process smoother and faster for borrowers who may not have all the standard documentation needed.

These progressive loans rely less on extensive financial records and more on your current financial standing.

This means you can often get approved faster, giving you the freedom to purchase your dream home without unnecessary hold-ups.

Low doc mortgages offer a compelling solution for borrowers who:

* Havelimited financial history.

* Are self-employed or have irregular income streams.

* Require prompt financing solution.

Investigate the potential of low doc mortgages today and see how they can help you achieve your homeownership goals with speed.

Gaining Your Dream Home: Low Doc Mortgage Lenders

Low documentation mortgages offer a streamlined route to homeownership for those who might struggle with traditional financing methods. These lenders focus on your ability to repay rather than demanding extensive records. If you're running your own business, have limited credit history, low doc mortgages could be your key.

- Research lenders who specialize in low documentation loans.

- Prepare the necessary financial information to demonstrate your ability to repay.

- Compare interest rates and terms from different lenders.

Don't let complexities stand in the way of your homeownership goals. With low doc mortgage lenders, you can simplify the financing process and achieve your dream of owning a home.

Streamline Your Finances: Low Doc Home Refinance Options

Lowering your monthly expenses can make a big impact in your finances. If you're looking to minimize your mortgage obligation, a low doc home refinance might be the perfect solution for you. These options are designed for borrowers who may not have traditional documentation, such as current tax returns or pay stubs. With a low doc refinance, you can often get accepted for a favorable interest rate and modify your loan terms to align your needs.

This type of refinance is a great way to combine debt, access cash equity for home improvements or other goals, or simply decrease your monthly payments.

To find the best low doc refinance choice for you, it's important to compare with multiple lenders and carefully review the terms and conditions before making a decision.

Searching for a Home Loan? Explore Their Low Doc Solutions

Purchasing a dream home shouldn't be hindered by paperwork. If you're facing challenges with traditional loan documentation, consider our flexible Low Doc solutions. We understand that everyone's financial situation is unique, and we strive to make the homeownership process as smooth as possible.

- Their streamlined application process requires minimal documentation, allowing you to qualify for a loan efficiently.

- They offer competitive interest rates and flexible repayment options to suit his individual needs.

- With our expert guidance, you can navigate the complexities of home financing with ease and confidence.

Contact us today for a free consultation and let our team help you achieve your homeownership goals.

Fast Approvals, Flexible Requirements: Low Doc Mortgages Explained

Are you looking to buy home but facing traditional mortgage hurdles? Explore low doc mortgages! These innovative mortgage products simplify the process by offering quicker approvals and adaptable requirements. Whether you're a entrepreneur, or have limited documentation, low doc mortgages can provide the access to your dream home.

Unlike conventional mortgages, low doc loans often necessitate less financial records. This means you can obtain mortgage approval faster and with simplified procedures.

- Discover the key advantages of low doc mortgages:

- Fast approval times: You can receive a mortgage decision within a week.

- Flexible documentation requirements: Your income sources are considered more flexibly

- Simplified application process: The application is often streamlined for faster processing

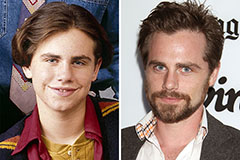

Rider Strong Then & Now!

Rider Strong Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!